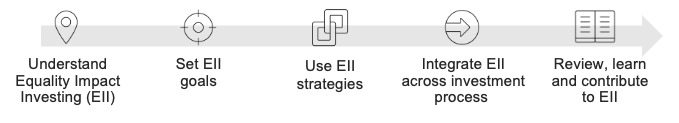

Integrate Equality Impact Investing Across Investment Process

How can equality impact investing be built in the investment process?

Click the icon of the section you’d like to go to

After the equality impact investing (EII) strategy/ies are chosen, you can apply it/them to your investment process and adapt your current practices. As investors improve their own equality practices, the equality impact investment process itself should also become more equitable (see here for EII principles). The following sections will guide you through how to integrate EII principles across all stages of a typical investment process, from planning and investment thesis to deal-making and monitoring.

Planning – power analysis

In order to achieve any of the EII strategies, it is important for the investment process itself not to perpetuate further inequalities. In an investment process, there will be social interactions between Investment Committee members and Executive team, between the funding team and investees. Social interactions come with power, so it is important to understand how power currently manifests in your investment process. Criterion Institute provides a set of thought-provoking questions for you to examine the power dynamics of your investment:

Knowledge: What skills and experience are we valuing across investments? Are there skills and experience relating to equality that we are not valuing?

Access: Who currently has access to our capital and resources? Do we have bias on who we consider as ‘worthy’ to access capital and resources? Are we being accessible enough?

Decision-making: Who holds power across the decision-making processes and who does not? Are we representing a diverse group of people and people who are ultimately impacted by the investments?

Timing: Do we make decisions based on our own timeframe or our investees’ timeframe? Do we have a sense of urgency in how we make investments?

Transparency: Are we being transparent about how we share information with different parties?

Risk sharing: Are we being fair in the way we distribute risks between ourselves and who we invest in? Have we taken into account the risks of inaction or not addressing inequality?

Alignment: Do we provide incentives for ourselves and our investees to achieve equality goals, and how they balance between impact and financial objectives?

+ CASE EXAMPLE - Pacific RISE

- Geographic scope: International

- Investment process: Planning; due diligence; deal-making

- EII strategy: Improve investors own make up and practice

- Source: Pacific RISE – The Design of a Power Dynamics Framework

- About: Pacific RISE, a program funded by the Australian Government’s Department of Foreign Affairs and Trade, operates across 14 Pacific Island countries and aims to attract over $10million of new private investment into the region by July 2021.

- What were the problems: Created based on a traditional impact investment model, Pacific RISE reviewed its first 14 deals to understand how to better support the success of the deals. The portfolio analysis concluded that their existing finance models are underpinned by a long-standing culture value around power dynamics – that those who hold the most capital deserve the most power:

- Investor risk profiles are privileged over entrepreneur and community risk.

- Preference for high-growth scalable equity opportunities is normative.

- Deal terms are often sourced from finance-first models rather than being contextualised, and can be inappropriate in social investment contexts.

- What they did in EII: With Criterion Institute’s framework, Pacific RISE analysed its power dynamics and shifted its strategy from a “top-down” to “bottom-up” approach where business and community needs are informed by the Pacific countries. The power dynamic framework is also used for early-stage due diligence processes for new partners and opportunities.

- What we can learn: What power dynamics do you have with your investees and stakeholders? What can you do to address it?

Investment thesis (fund level)

As an investor, you should have an investment thesis that articulates various elements of your investment, such as your goals for your portfolio, the types of capital to employ, the stages of investees, role as an investor, sector focus, geographical focus, business model focus and so on. Across all these elements, you should consider how equality impact investing can be integrated. Some high-level questions to consider are:

If you are currently operating a fund already, where can you strengthen the focus on equality in your investment thesis?

If you are currently working on a new fund, how has learning from your equality analysis helped you think about the investment thesis?

Some more specific considerations are:

Do you want to be a more active investor to help realise the equality goals of your investees?

Do you want to focus on any kinds of business models, such as worker cooperatives?

Do you have any geographical focus – place-based, national, or international?

Do you see yourselves adding most values in certain sectors, to tackle inequalities?

+ CASE EXAMPLE - Access Foundation

- Geographic scope: Place-based

- Investment process: Investment thesis (fund level)

- EII strategy: Target inequality mitigating organisations; Target equality transformative organisations; Target ventures with good equality and diversity practice

- Source: Access Foundation

- About: Access Foundation is an impact investment wholesaler that supports charities and social enterprises in England to be more financially resilient and self-reliant.

- What they did in EII: Access Foundation addresses inequality in impact investing through supporting sector-wide initiatives (such as Equality Impact Investing Project and Diversity Forum); enabling equality focused organisations to develop their enterprise models (in collaboration with partners such as Equally Ours and Ubele); requiring social investment intermediaries who are delivering its blended finance programme to demonstrate how they are using EII principles.

- What we can learn: How can you support different ecosystem actors to drive structural changes towards equality? Who can you partner with to achieve your equality goals?

+ CASE EXAMPLE - Equality Fund

- Geographic scope: Global

- Investment process: Investment thesis (fund level)

- EII strategy: Capital to marginalised entrepreneurs; Target inequality mitigating organisations; Target equality transformative organisations

- Source: Equality Fund

- About: The Equality Fund is a collaboration set up in June 2019 in Canada to drive the cultural, economic and political changes required to make global gender equality a reality.

- What were the problems: Since October 2013, its predecessor, the MATCH Fund, had provided 75 grants to 32 partners in 26 countries. However, they found that:

- Women’s rights organizations around the world were still doing the most work with the least resources.

- Canada still provided only a fraction of its international aid directly to women and girls at the grassroots.

- Less than 8% of philanthropic dollars ever left Canada’s borders.

- What they did in EII: The Fund aims to fundamentally shift money and power to dramatically expand the total resources available to women and girls around the globe. They deploy gender-lens investing, government funding and multi-sector philanthropy for feminist movements globally. It also adopts an intersectional approach, supporting women that are immigrants, Indigenous people, from LGBTQI+ communities, with disabilities and so on.

- What we can learn: What is the structural inequality challenge that you want to tackle? What investment strategy can you use to tackle it?

Investment thesis (product level)

Investors should also consider the types of investment products to deploy to realise equality impact investing. It is possible that the investment products you offer could prevent you from reaching the populations you want to support equality impact within, considering dimensions such as affordability and other product features. Consider how you can innovate and adapt your investment products to enable equality impact investing to flow (i.e., addressing gaps between supply and demand) as well as to be compatible with EII principles.

If you are already offering specific products in your investment fund, do you think they are in line with the principles of EII? Why or why not?

If you are coming up with new products, what can you take from your inequality analysis to innovate?

+ CASE EXAMPLE - ACH Yield Sharing Finance Model

- Geographic scope: Place-based

- Investment process: Investment thesis (product level)

- EII strategy: Target inequality mitigating organisations

- Source: ACH Yield-Sharing Finance

- About: Ashley Community Housing (ACH), a housing association that supports refugees to resettle and integrate into the UK, aimed to diversify their property portfolio from a leasehold model to a freehold model. They raised social investment to fund this new model.

- What was the problem: To reflect the values of its staff and tenants, who are predominantly Muslim, ACH wanted a social investment model that doesn’t rely on interest, that is Sharia compliant and suitable for faith-oriented investors.

- What they did in EII: ACH worked with Resonance, a social investment company, to develop an investment product based on a yield sharing model, an alternative social investment structure that is ethical and inclusive to all communities. While investors benefit from their share of net yield of the properties purchased (the annual rental income minus ACH’s costs for managing the properties), the investee can maintain a balance with investors where risks, gains and power are shared between both sides.

- What we can learn: What can you do to innovate your investment products to be accessible to your stakeholders?

Sourcing investment

Once you have an investment thesis in line with EII principles, for both fund level and product level, you can start to source investments. It is important to consider how you can partner and leverage other ecosystem players to help your sourcing:

How are you currently sourcing investments, and from whom?

Can you be more open and transparent in how you source investments?

Are there opportunities for partnerships with other investors and ecosystem players?

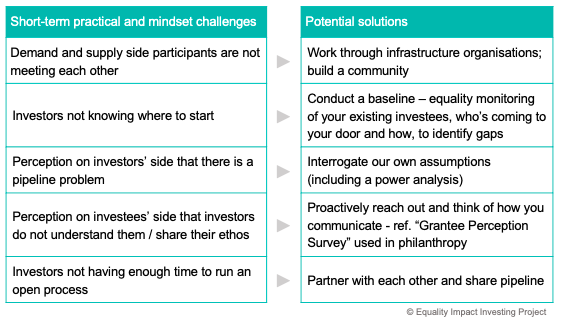

When sourcing investment, here are some common mindset challenges that you might face and potential solutions to them.

+ CASE EXAMPLE - Ada Ventures’ “Scout Community”

- Geographic scope: International

- Investment process: Souring investment

- EII strategy: Capital to marginalised entrepreneurs; Improve investors own make up and practice

- Source: Ada Ventures

- About: Ada Ventures is a pre-Series A venture capital fund investing in diverse founders tackling societal problems through technology.

- What were the problems: As founders from marginalised backgrounds lack access to early stage capital, the VC community itself is not diverse either.

- What they did in EII: Ada Ventures seeks out start-ups by and for underserved (or “overlooked”) founders and markets, such as women, LGBTQ+ and disabled founders. They expand their reach through their “Scout Community”, where people from underrepresented communities contribute as a “scout” to identify diverse founders. Scouts are incentivised through a cash payment and long-term carry-linked payment.

- What we can learn: What can you do to expand your engagement with the communities you want to support?

Resources

Diversity.vc provides VCs with the tools and practices they need to open their networks and make funding available to underrepresented founders, as well as the resources needed to cultivate an environment where founders and colleagues from all backgrounds feel they belong in the industry and the ecosystem.

Screening and due diligence

Reviewing equality practice and diversity considerations as part of the due diligence process is important as it can inform your understanding of investees’ potential to achieve equality impact. To embed EII principles in your screening and due diligence process, consider:

How can you ensure that your screening and due diligence criteria do not exclude the populations/investees you want to impact?

How can you adapt your due diligence process to be more equitable? How can the process be more transparent, simple and rapid?

Can you think of benchmark data you can use to understand the context of equality within your potential investees?

Can you conduct a high-level equality impact assessment of your potential investees – or at least to consider whether they have good equality practice, whether they are equality transformative or inequality mitigating?

Would it be possible to use this as a positive screen to maintain balance in your portfolio?

Do you currently review beneficiary and investee diversity as part of your investment due diligence and evaluation process?

+ CASE EXAMPLE - Women in Safe Homes Fund

- Geographic scope: National

- Investment process: Investment thesis (fund level); Screening and due diligence; Monitoring and evaluation

- EII strategy: Target inequality mitigating organisations

- Source: Women in Safe Homes

- About: The Women in Safe Homes Fund, the first gender-lens property fund in the UK, aims to raise £100 million to invest in residential homes and refuge accommodation across the UK for women and children suffering from domestic abuse, experiencing homelessness, leaving prisons or having complex needs. It acquires housing units and leases them to charity partners, who can then lease to qualified tenants and help women find housing.

- What were the problems: The Fund saw a strong demand from women for safe and secure homes, because:

- Domestic abuse is one of the main causes of homelessness for women and children, while specialist refuges turn away 60% women referrals due to no spaces.

- Homelessness impacts women’s mental health, which in return hinders women from dealing with housing issues.

- 60% of female prison leavers do not have a home due to lack of suitable housing.

- What they did in EII: The Fund aims to support women in challenging situations to access affordable and suitable housing. By consulting with grassroots charities providing housing and support to women, the Fund designed many elements that aimed to meet the stakeholders’ expectations, including:

- Changed the process of selecting fund managers.

- Incorporated people with lived experience in the fund management team.

- Designed outcome metrics with charity partners - metrics went beyond obvious ones (e.g., number of women supported) to those that the charity partners care about (e.g., whether women feel empowered and safe, women’s relationship with their families and children after moving to new homes).

- What we can learn: How can you learn from stakeholders to provide better support to the populations you want to serve? How can you change due diligence and the way you manage the fund, to be more equitable? How can you apply positive screening to inform decision making?

Resources

Benchmark data

Equileap provides gender equality benchmark data built on over 3,000 companies across 19 data points to support investors to build gender lens financial products, from fair pay and recruitment to supply chain management.

Equitable due diligence

EHRC’s Human rights due diligence for boards to ask their executive teams.

Due Diligence with a Gender Lens by Criterion Institute (2015): a framework based on Values, Relationships and Processes for gender lens due diligence.

Due Diligence 2.0 Commitment: Nine considerations to help shift and allocate more capital to BIPOC (black and Indigenous people of colour) managers.

Investment decision-making

Until this stage, you will have shortlisted investment opportunities with EII principles incorporated throughout your investment planning, thesis, sourcing and due diligence. To truly channel investment to achieve your equality impact goals, it is important to have a decision-making process that also complies with EII principles. Consider:

Who is on your Investment Committee?

What are the decision-making criteria? Is equality impact part of the decision-making criteria?

Are there other ways of making decisions that you think will be more aligned with the EII principles?

Inequality should be seen as a risk that affects the bottom-line. Can you think of an example that might illustrate this among your investment and/or your potential investees?

+ CASE EXAMPLE - Village Capital peer-led selection model

- Geographic scope: Global

- Investment process: Screening and due diligence; Investment decision-making

- EII strategy: Capital to marginalised entrepreneurs

- Source: Flipping the Power Dynamics Village Capital

- About: Village Capital is a venture capital firm investing in impact-driven, seed-stage start-ups across the world.

- What were the problems: Village Capital observed that a fundamental issue in the lack of capital to certain groups of founders (e.g., women, Black and Latinx) is the implicit bias of venture capitalists who are often distanced from communities.

- What they did in EII: Village Capital challenges the power dynamics between VC and entrepreneurs and adopts a collaborative due-diligence model that takes a bottom-up approach to investing in early-stage start-ups. Village Capital involves groups of early-stage, high-growth entrepreneurs across the due diligence process and gives them the power to make a collective decision on who should receive investment. Through this process, entrepreneurs learn to assess their peers, as well as their own companies, through the eyes of an investor. A study of the Village Capital model has found two main advantages of this approach: “While entrepreneurs do not have the formal training of analysts in venture capital firms, but they are much closer, personally, to the customer problems being addressed. And, in most cases, they have a much stronger personal understanding of risk.” Moreover, the entrepreneurs were significantly more likely to highly rank female entrepreneurs than were the experts - this is important as female entrepreneurs are not accessing funding at the same rate as their male counterparts.

- What we can learn: How can you enhance participation from your stakeholders in the decision-making process? How can you share the power of decision-making with people who may know better/best about the businesses/services?

Resources

SheEO’s collective decision-making model to enhance participation

Social Investment Business’ data-led decision-making for more objectivity

Deal-making and deal terms

There could be implicit bias in the investment deal terms, as well as how investors negotiate with investees. In line with EII principles, consider how you can avoid negative equality impact in deal-making, and have deal terms that hold both investors and investees accountable to achieve positive equality impact. Think about:

Is your deal-making and negotiation process in line with EII principles? Consider your power analysis.

Are your deal terms and the legal jargon unintentionally working against the spirit of equality?

Can you deal terms be more explicit in driving equality goals?

Some sample deal terms you may consider including: “The company strives to create and maintain a diverse team, especially at leadership level. One that’s inclusive across gender, ethnicity, age, sexual orientation, disabilities, socio-economic background and national origins. Such implementation and progress shall be discussed on a regular basis with the Board.”

+ CASE EXAMPLE - Thousand Currents Buen Vivir Fund

- Geographic scope: Global

- Investment process: Screening and due diligence; Deal-making and deal terms

- EII strategy: Capital to marginalised entrepreneurs

- Source: Thousand Currents Buen Vivir Fund

- About: Thousand Currents is a grantmaking non-profit that supports grassroots organisations and movements led by women, youth, and Indigenous Peoples on food sovereignty, alternative economies and climate justice. Thousand Currents’ Buen Vivir Fund is a participatory impact investment fund aiming to support practices already proven effective on the ground.

- What they did in EII: The Fund has a Members Assembly, which is composed of grassroots organisations and investors, to govern and manage the Fund with equal representation and voting rights. As a part of due diligence, the Members Assembly conduct peer evaluation to approve investment in forms such as grant, debt and other support. When the debt is due, as a part of the deal terms, projects return 100% of the principal received, as well as a solidarity contribution (“an aporte payment'') self-determined by organisations during or upon completion of successful projects.

- What we can learn: How can you enhance participation in the deal-making process? How can you hold investors and investees accountable to the equality impact goals in the deal terms?

Resources

Gender Lens Investing: Legal Perspectives by Calvert Impact Capital on how investors incorporate gender considerations into the legal documentation and terms of their investment

Monitoring and evaluation

Impact measurement and management (IMM) is an essential part of impact investment, so is evaluating equality impact for EII. To understand the achievement of your equality impact goals, you need to both collect and evaluate equality impact data. The process should align with EII principles, consider:

Are you conducting equality impact assessment and do the metrics used incorporate human rights considerations?

Are you collecting equality data and what are you using it for?

Are you using the SDGs, including SDG 10, as part of your impact measurement framework?

Can you co-produce metrics with your investees and encourage more equitable practice on evaluation among your investees as well?

Can you partner with other investors to reduce the burden on investees?

Are you publishing the data you collect publicly and back to your investees, not just to your investors?

+ CASE EXAMPLE - Boston Impact Initiative

- Type of investors: Place-based investor

- Investment process: Planning; Monitoring and evaluation

- EII strategy: Capital to marginalised entrepreneurs; Target inequality mitigating organisations; Target equality transformative organisations

- Source: Boston Impact Initiative website

- About: Boston Impact Initiative is a place-based fund investing in enterprises throughout Eastern Massachusetts, United States, that address the growing wealth gap and ecological challenges. As of 2019, they have invested in 25 organisations.

- What were the problems: Boston Impact Initiative started the fund with an ambition to close the racial wealth divide in the extremely unequal community of Greater Boston, where:

- It was ranked the number one most unequal city in 2016.

- There is an increasingly huge gap between the asset base of white and non-white households. The median net worth of white families in the metropolitan area is $247,500, while that of US-born black families is only $8.

- Almost twice as many black people in Boston are unemployed; four times as many black families are unbanked and less than a half own a home.

- Many of Boston’s entrepreneurs of colour face financial difficulties to start their business.

- Boston Impact Initiative believes that the problem is not lack of skill, creativity or commitment, but structural inequity.

- What they did in EII: With a goal to close the racial-wealth divide in Greater Boston, the Initiative supports low-income entrepreneurs to build credit, access capital, gain mentoring and technical support and leverage social networks beyond their own neighbourhoods. The Initiative also partners with their portfolio companies to co-produce a 40-question Impact Assessment, which is used to assess the investees’ impact on closing the racial-wealth gap. Metrics include ownership by people of colour, access to quality jobs for economically marginalised groups, and closing the gender wage gap.

- What we can learn: How can you create equality impact metrics that are relevant and important to your investees?

Resources

A Transformative Evaluation Toolkit for The Impact Investing Sector

DEI Data Standard for the philanthropy sector

USERS methodology by The Social Investment Consultancy on inclusive monitoring, evaluation and learning

See example of diversity data sharing and transparency by Social Investment Business’ The Resilience & Recovery Loan Fund

EXIT

When conducting an exit, investors should be responsible to ensure long-term equality impact can be achieved. Consider these issues:

Is your exit in line with the EII principles?

Are you conducting an exit at an appropriate timing?

How have your equality impact goals been achieved? What are the positive and negative impacts you created?

How have you improved your operational and strategic investment decisions, with the findings from this investment?

Do you have the structure and process in place to continue supporting the sustainability of your equality impact?

+ CASE EXAMPLE

Exit from an impact and equality perspective is an evolving field, and any case examples from users of this guide would be very welcome. Some approaches to exit with an equality lens include:

- Exit to community: This exit strategy challenges two traditional ways of exit – get acquired or go public – which tend to benefit the start-ups and investors rather than the users/customers and the community. Exit to Community is developing some approaches that can shift the ownership to the start-ups’ communities, into forms such as for-profit firm, non-for-profit, cooperative, trust and policy tool.

- Employee ownership: Employee ownership, where a company’s employees own shares of their company, is seen by some impact focused organisations as a way to lock in their social missions with financial ambitions. Some impact investors have employee ownership as a part of their deal terms, requiring their investees to share or transit the ownership to their employees, through stock options or stock grants.

Resources

Impact Principles by International Finance Corporation states what responsible exit should be for impact investing

In Pursuit of Good & Gold: Data Observations of Employee Ownership & Impact Investment

Click the icon of the section you’d like to go to